“Crypto Investing 101: A Beginner’s Guide to Cryptocurrency, Best Wallets, Diversification Strategies, and Market Trends”

As the world of cryptocurrency continues to evolve, many investors are looking for a reliable platform to store their digital assets, manage their portfolios, and stay ahead of market trends. In this article, we explore the key concepts that every crypto investor should know.

Best Crypto Wallets: Choosing the Right Platform

When it comes to storing and managing your cryptocurrency portfolio, the right wallet is crucial. Here are some of the most popular wallets:

- MetaMask: A popular choice among beginners, MetaMask lets you store, send, and receive cryptocurrencies across multiple blockchains.

- Trust Wallet: This mobile wallet offers a user-friendly interface and supports over 5,000 cryptocurrencies.

- Ledger Nano X

: A hardware wallet that offers advanced security features and supports over 1,000 cryptocurrencies.

When choosing a cryptocurrency wallet, consider the following factors:

- Security: Look for wallets with strong encryption and two-factor authentication.

- Ease of use: Choose wallets with a simple and intuitive interface.

- Customization: Consider wallets that allow you to customize your wallet settings and create custom addresses.

- Support: Make sure the wallet supports all the cryptocurrencies you want to store.

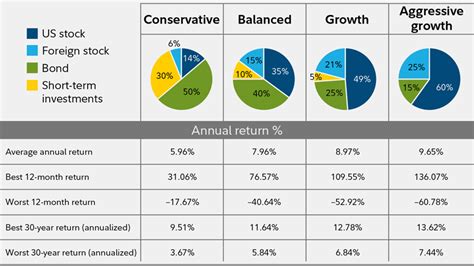

Portfolio Diversification Strategies

Diversifying your portfolio is essential to minimizing risk and maximizing returns. Here are some popular strategies:

- Asset Allocation: Divide your portfolio across asset classes, such as stocks, bonds, and cryptocurrencies.

- Sector Rotation: Focus on industries that are expected to perform well in the short term.

- Following the Trend: Invest in assets that are trending up.

Consider the following to diversify your portfolio:

- Spread your investments across asset classes (e.g. 50% stocks, 30% bonds, 20% cryptocurrencies).

- Rotate between industries every few months to avoid overexposure.

- Consider using stop-loss orders and position sizing techniques to manage risk.

Mempool: A Key Factor in the Cryptocurrency Ecosystem

Mempool is a popular blockchain network that allows miners to validate transactions and receive rewards. Here’s how it works:

- Mining: Miners compete to solve complex mathematical puzzles that secure the network and reward them with new cryptocurrency blocks.

- Transaction Validation: Mempool nodes validate transactions and ensure they are legitimate and valid.

- Reward Sharing: Miners who validate transactions receive a share of the rewards when new blocks are created.

Use Mempool effectively by:

- Join a mining pool to improve your chances of validating transactions efficiently.

- Participate in auctions for rare coins or high-end GPUs to get better rewards.

Conclusion

Investing in cryptocurrency can be a lucrative venture, but it requires solid knowledge of the markets and strategies. By choosing the right wallet, diversifying your portfolio, and staying up to date with market trends, you are well on your way to becoming a successful crypto investor. Remember to always stay up to date with industry developments and adjust your strategy as needed.

Disclaimer

This article is for informational purposes only and should not be construed as investment advice. Always do your own research and consult a financial advisor before making any investment decisions.

بدون نظر